It’s Time to Take Another Look at Blockchain

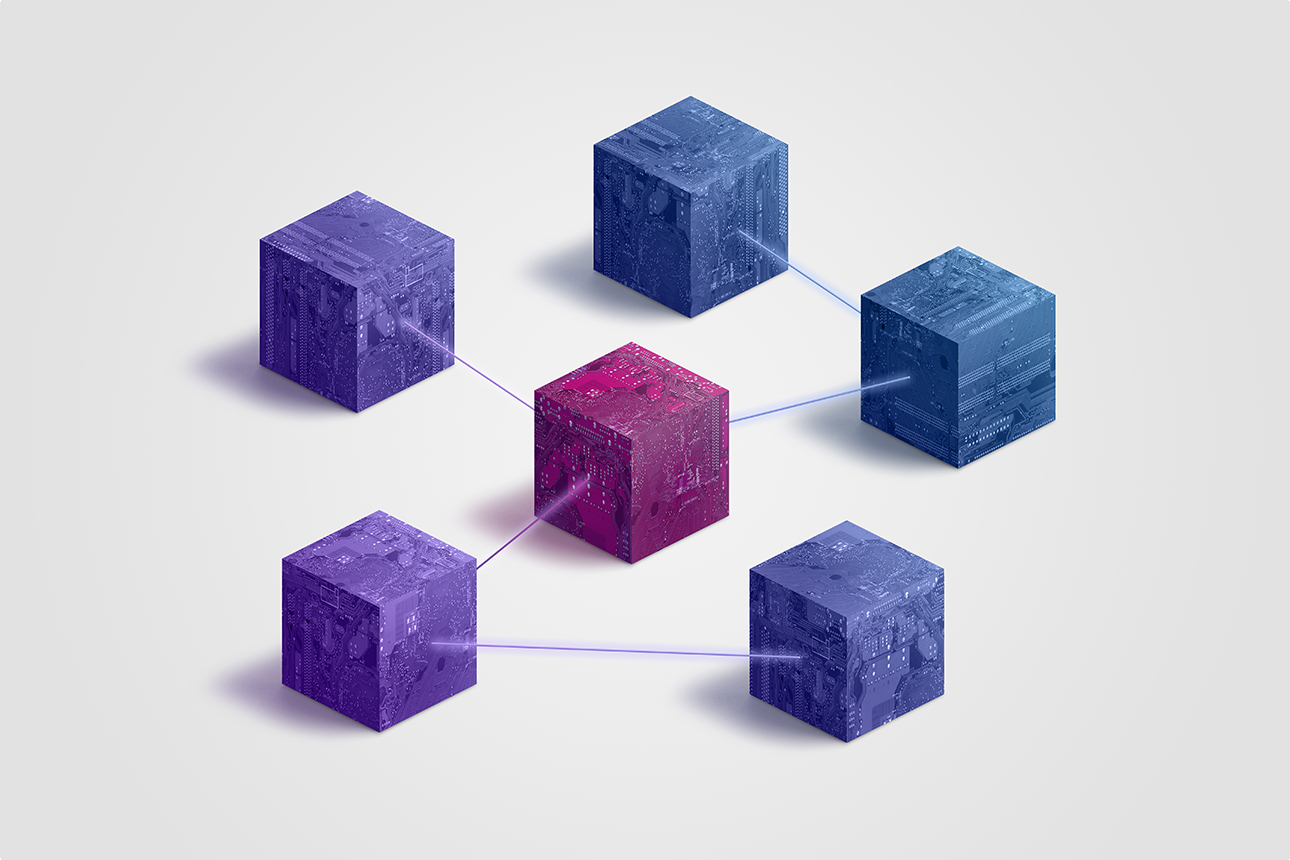

The leaders of large incumbent companies should embrace the potential of distributed ledger technology before it gets used against them.

It wasn’t long after the developers of bitcoin first used a distributed ledger to record transactions in 2008 that the blockchain revolution was announced with all the fanfare that usually accompanies promising new technologies. Then, as often happens with emerging technologies, blockchain’s promise collided with developmental realities.

Now, a decade and a half down the road, that early promise is becoming manifest. In his new book, Enterprise Strategy for Blockchain: Lessons in Disruption From Fintech, Supply Chains, and Consumer Industries, Ravi Sarathy, professor of strategy and international business at the D’Amore-McKim School of Business at Northeastern University, argues that distributed ledger technology has matured to the point of enabling a host of applications that could disrupt industries as diverse as manufacturing, medicine, and media.

Sarathy spoke with Ted Kinni, senior contributing editor of MIT Sloan Management Review, about the state of blockchain, the applications that are most relevant now for large companies, and how their leaders can harness the technology before established and new competitors use it against them.

MIT Sloan Management Review: Blockchain has been slow to gain traction in many large companies. What’s holding it back?

Sarathy: Blockchain is a complex technology. It is often secured by an elaborate mathematical puzzle that is energy intensive and requires large investments in high-powered computing. This also limits the volume of transactions that can be processed easily, making it hard to use blockchain in a setting like credit card processing, which involves thousands of transactions a second. Interoperability is another technological challenge. You’ve got a lot of different protocols for running blockchains, so if you need to communicate with other blockchains, it creates points of weakness that can be hacked or otherwise fail.

Aside from the technological challenges, there is the issue of cost and benefit. Blockchain is not free, and it’s not an easy sell. It requires significant financial and human resources, and that’s a problem because it’s hard to convince CFOs and other top managers to give you a few million dollars and a few years to develop a blockchain application when they do not have clear estimates of expected returns or benefits.

Lastly, there are organizational challenges. A blockchain is intended to be a transparent, decentralized network in which everyone talks to each other without any intermediaries organized in a world of hierarchies.

Comments (2)

reza labbafi

seng yeoh